-

T. Piketty, "A Brief History of Equality"책 읽는 즐거움 2022. 5. 6. 07:08

Thomas Piketty, "A Brief History of Equality" (2021, 영영본 2022)

< 발췌 >

[P]ower relationships must be neither ignored nor sanctified. Struggles

play a central role in the history of equality, but we must also take

seriously the question of equitable institutions and egalitarian

deliberation about them. (p. 15)

Slavery has played a central role in the development of the United

States, which at its creration resembled a genuine slaveholding

republic. Of the fifteen presidents who preceded Lincoln, no less than

eleven owned slaves, including Washington and Jefferson. (p. 80)

[I]n the last months of the war, in January 1865, the Northerners

promised the emancipated slaves that after the war was won, they

would each receive "forty acres and a mule." ... But as soon as the war

stopped, the promise was forgotten, no law providing for compensation

was ever passed, and "forty acres and a mule" became a symbol of

Notherner's deception and hypocricy. (pp. 82-83)

The current distribution of wealth among the countries of the world

and within countries bears the deep mark of slaveholding, colonial

past.... Rejecting any discussion of reparations ... considerably

complicates the development of new norms of universal justice that

are acceptable to all. (p. 93)

The growth of weath in the Westen world ... has long been based on

the international division of labor and the feverish exploitation of

natural and human resources worldwide. All these accumulations of

wealth ... depend on a global economic system, and it is at that leve

that the question of justice should be raised and the march toward

equality pursued. (p. 94)

The republics of France and the United States were in essence

slaveholding, colonial, and legally discriminatory until the 1960s. The

same was true of the British and Dutch monarchies. Almost

everywhere, the equality of rights proclaimed at the end of the

eighteenth century is above all an equality of White men, and

especilly of property-owning White men. (pp. 95-6)

Almost everywhere, the tax deductions that are granted for political

contributions, as well as for other kinds of donations, amount to

subsidizing the wealthiest people's political or cultural preferences

with the money of the poorest.... The question of how to finance the

media, think tanks, and other organs that shape public opinion

raises the same problems. (p. 109)

In Germany, the system known as "comanagement" ... consists in

dividing up the seats in a company's board of directors ... The 1976

law established the system in force in Germany, with one-third of the

seats for employees in companies with between 500 and 2,000

employees, and half the seats for those with more than 2,000

employees. (pp. 113-4)

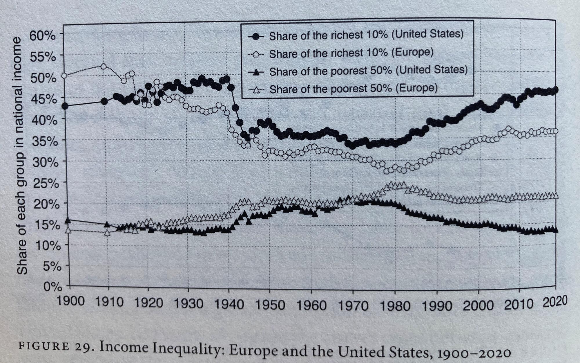

Between 1914 and 1980, inequalities in income and wealth decreased

markedly in the Western world as a whole (the United Kingdom,

Germany, France, Sweden, and United States).... The first factor was the

welfare state's spectacular rise in power. This long term development

was in large measure the result of social struggles and mobilization of

the socialist and labor movements since the end of the nineteenth

century. Nevertheless, it was greatly accelerated by two world wars and

the depression.... The second factor was the development of a very

progressive tax on income and inheritance. ... Finally, we shall see the

essential role played by the liquidation of foreign and colonial asstes,

and how the dissolution of public debt helped to reduce inequlities

and destroy perceptions of private property as sacred. (pp. 121-2)

(pp. 153-4)

If the Reagan-Thatcher revolution had such an influence after 1980, it

was not only because it benefited from broad support within the

dominant classes and powerful network of influence through the

media, think tanks, and political financing .... It was also because of

the weaknesses of the egalitarian coalition, which failed to produce

a convincing alternative narrative and nuture a sufficiently strong

popular movement rallying around the welfare state and progressive

taxation. (p. 155)

[P]rogressive taxation, as it functioned in the course of the twentieth

century, enabled us not only to more fairly distribute taxes on wealth

and income but also to impose narrow limits on inequalities before

taxes. This role of predistribution and not just redistribution was

absolutely central. (p. 157)

The basic income systems currently in place in most European

countries suffer from multiple insufficiencies, notably regarding access

for the youngest and for students, as well as for persons who are

homeless or who do not have bank accounts. Moreover, it is essential

that the basic income scheme also cover people with low wages and

income from work. (p. 158)

A more ambitious tool that could be used along with basic income is

the system of guaranteed employment recently proposed in the

context of discussions of the Green New Deal. (pp. 158-9)

For example, this minimal inheritance could be equal to 60 percent

of the average weath per adult, paid to each person at the age of

twenty-five. This capital endowment could be financed by a

combination of a progressive tax on wealth and on inheritances.

levying approximately 5 percent of the national income, whereas the

financing of the welfare state and ecological programs (including basic

income and guaranteed employment) would be financed by a unified

system of progressive income taxes, including contributions for social

welfare and tax on carbon emissions, levying about 45 percent of the

national income. (p. 160)

I assert that the idea of an inheritance for all presented here is

meaningful only if it is added to systems of basic income and

guaranteed employment, which ought to be established first, and

more generally, only if the inheritance for all is added to an existing

welfare state system, whse obective is the gradual dcommercialization

of the economy. In particular, fundamental goods and services in

domain such as education, health care, culture, transportation, or

energy are by nature to be produced outside commercial sphere, in

the context of public, municipal, group or nonprofit structures.

(pp. 164-5)

[W]e must also adopt a system of egalitarian financing for political

campaigns, the media, and think tanks, in order to prevent electoral

democracy from being co-opted by those who are better off. (p. 167)

Long contested, gender parity and quotas benefiting women have

spread in many countries and are now broadly accepted. The same

cannot be said about ... those who have experienced social,

ethno-racial, or religious discrimination. (p. 189)

In this book, I have defended the possibility of a democratic and

federal socialism, decentralized and participatory, ecological and

muticultural, based on the extension of the welfare state and

postcolonial reparations, the battle against discrimination, educational

equality, the carbon card, the gradual decommodification of the

economy, garanteed employment and inheritance for all, the drastic

reduction of monetary inqualities, and finally, an electoral and media

system that cannot be controlled by money. (p. 237)

If Western countries, or some of them, were to abandon thier habitual

capitalist and nationalist postures and adopt a discourse founded on

democratic socialism and an exit from neocolonialism, with major steps

toward fiscal justice and sharing the tax receipts of the multinationals

and billionaires all over the world, that would make it possible not only

to regain credibility with regard to the global South, but also to drive

Chinese authoritarian socialism into a corner in matters of transparancy

and democracy. On central questions such as ecology, patriarchy, and

xenophobia, the truth is that at this point none of the present regimes

has any particulary convincing lesson to teach others. Only a dialogue

between systems and a healthy emulaton might allow us to hope for

some progress. (p. 238)

덧붙임 (11/6/2022): Books on Inequality

'책 읽는 즐거움' 카테고리의 다른 글

Carlo Rovelli, "The Order of Time," "Seven Brief Lessons on Physics" (0) 2022.05.18 Evan Osnos, "Wildland" (0) 2022.05.10 일본인 수용소 (태평양 전쟁 중 미국과 카나다에) (0) 2022.05.02 Amy Bloom, "In Love: A Memoir of Love and Loss" (0) 2022.04.26 "Caste" "The Feast of the Goat" (0) 2022.04.24